“Looking at the world through a sustainability lens not only helps us ‘future proof’ our supply chain, it also fuels innovation and drives brand growth.” -Paul Polman

In Part I of our look into the Sustainability of Money Transfers, we took a dive into the energy and resource consumption of Fiat Money and the current financial environment. Today, we take a closer look at the sustainability of exchange systems more closely related to the coin in question, Bitcoin. The blockchain networks discussed here are operating on a PoS (Proof of Stake) system, differing from the PoW (Proof of Works) operations behind the BTC chain.

The environmental impact of Bitcoin would be dramatically less, had it been built on a PoS system rather than PoW. The simple differences in how they operate and the necessary resources to operate in general speak for themselves in answering how the two differ in sustainability.

PoW Vs PoS:

- PoW, or Proof of Works, is the method to the madness which is creating controversy in the BTC world. This method requires validators in a network to perform an amount of work (usually in the form of math equations) in order to form an accurate, secure and transparent consensus on the validity of blocks, coins, hashes and transactions. Introduced with the intent to deter spam attacks and data tampering, this has come to be the basis of the world’s most popular cryptocurrency, and various others such as the current version of Ethereum.

Systems like these require computing power to be exhausted so that a validation can occur through the solving and giving of a correct answer to a math problem given by the protocol’s algorithm for consensus. The result of having to perform such tasks for every part of data exchange is the need for nodes to be running 24/7 for these “mining” processes to occur. The nodes or miners often set up a number of different computers with a variety of add-on devices to process transactions, build blocks and mint new coins into the network in order to keep it running.

The numbers add up quickly for these miners: cost of power, although a number of them (roughly 73% as of Dec. 2019) use renewable sources to run their equipment.; Equipment and the cost of updating and securing their nodes with add-on devices and software.; Difficulty in solving the equations also increases as blocks are built and as rewards are cut (making them more valuable).

The amount of power needed to run the Bitcoin network alone is incredibly high with the amount of mining technology out there. Although significantly less than fiat currency, BTC leaves a rather noticeable footprint. These inefficiencies have been noticed by a good lot of DeFi developers, which brings us to the crypto alternative: Staking and PoS.

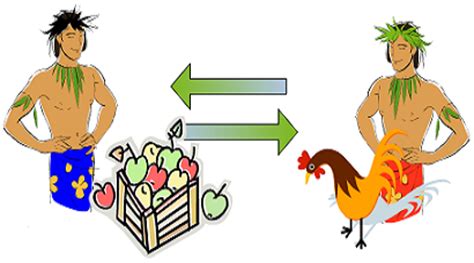

- PoS, or Proof of Stake, is the operational system behind various other cryptocurrency networks such as Tezos, Stellar, and Binance. In staking, miners or validators are only required to have coins of the protocol to “stake” in order to validate transactions and produce tokens. Coins are mined and blocks are built based on the amount of coins they hold.

Staking is done by taking the coins one holds and placing them in an account where new blocks, shards and coins are created from the staked coin. The staked assets bring value to the network and are offered as a value certifier. The coins hold information as a “valid standard” to which the algorithm of the new coin may match against the old coin. Rewards are then given to stakers and miners in the form of the protocol’s native coin, because you helped add more equity to the network whilst risking your own tokens.

Staking done by miners limits the influence of miners and offers a wider span of validation, increasing security and scalability. More validators means more transaction validations being done in a shorter amount of time, increasing speeds and transfer times. This system allows anyone to add value to a network, decreasing the leverage of miners over the network. With the amount of coins in circulation vs. a single holder, the percentage of their holdings is often much lower than the majority of the network holders and providers, incentivizing the miners to help sustain the market rather than attempt to tamper or manipulate it.

Staking can be risky for the inexperienced investor trying to earn a decent (a lot better than your bank account) amount of interest/ rewards for staking assets. Why? Well some protocols ask that you willingly stake your coins in their network. Some are locked in and cannot be withdrawn or moved. Others are easily moveable, and some protocols even have staking built into their system where each holder of coins can see growth in their portfolio simply for holding the coin. It’s always suggested that you know the coins which you’re invested in as well as the staking platforms you use to capitalize on your investments. Always do your research.

So how does PoS compare to Bitcoin’s PoW?

Well, the answer is simple: Proof of Stake systems are clearly more sustainable and better overall for the environment. Using less resources in terms of hardware and computing power by cutting out mining, staking not only offers more sustainability, but more scalability and security. More transactions can be made in a shorter amount of time, using exponentially less power per transaction than Proof of Works based exchanges. In every way, even with nodes having to be run 24/7, PoS is much more environmentally conscious than anything run on a mining and works sustained protocol. The reason Ethereum 2.0 is making its way to the stage is because of the recognition of the Ethereum developers of the overall innovative potential of Staking.

Thank you all for reading, come back for more on crypto, sustainability and other free market changes, influencers and values. Please subscribe, check out our podcast and stay tuned for more!

Great read