“No one can possibly have lived through the Great Depression without being scarred by it. No amount of experience since the depression can convince someone who has lived through it that the world is safe economically.” –Isaac Asimov

As economic fears grow in suspicion of a possible recession, today we take a look back at one of the most devastating economic experiences industrialization has ever known: The Great Depression. After the roaring twenties, where Americans saw their collective wealth rise higher than ever before, the world saw a dramatic drop in economic growth and activity towards the end of 1929. This “depression” lasted a long 10 years, officially ending in 1939, though solutions were pursued and in action during the early/mid 30s.

What Is A “Depression”?

Before we dive into the causes and effects of the great depression, let’s start by explaining what exactly characterizes a “depression”. Depressions are often looked at as long-term recessions, or recessions that last longer than a period of three years, depending on who you ask; some say 1-2 years others would even say longer than three years. They are basically the same in essence, but a depression is a prolonged and sustained drop in activity and growth.

Depressions are seen in a consistently declining economic environment: rising unemployment (20%+), low consumer spending, production slow down and a loss of investor confidence. A continuous decline in GDP (what the wealth of a nation is measured by) of at least 10% is one of the key signs. We would see higher rates of bankruptcy, poverty and job loss. Famines and pestilence can also harm the sphere of commerce when they reign over agricultural activity for a period of time: food shortages, more production loss and even more job loss. Depressions define themselves. It’s a sad time in any place that experiences depression.

What Exactly Happened?

It all started in the years leading up to 1929. The growing economy was accompanied by the Fed’s inflationary action. Printing amounts of money, they shot up the monetary supply and fueled the rise in stock values and real estate. The Federal Reserve was the only single entity with enough power to uphold the financial system, only to help bring it to collapse.

Wall Street investors seemingly vanished as the stock market crashed due to exponentially overvalued stocks and a market with high volume. Stocks were seen as an opportunity for all to make a good chunk of change to go and live the American dream. They helped the economy grow, and people came in droves to put their money in. This mass influx led to a bubble that was waiting to burst. Investors noticed the overvaluation and there was a mass panic-sell-off. Black Thursday led to black Tuesday where the market had dropped 90% from it’s year high. This left countless portfolios in the mud, unable to be saved. From the peak right into the trough. Rough, to say the least.

The crash led to more problems, or rather added to the existing problems. The recession from whence the great depression derived had already begun earlier that year. After years of never-before seen growth, the economy saw a downturn in activity. Production and output were slowly dropping as consumer spending did the same. The values of businesses were definitely not matching the value of their stocks. It was the crash that sort of set the depression on the path to “greatness”.

Past The Crash

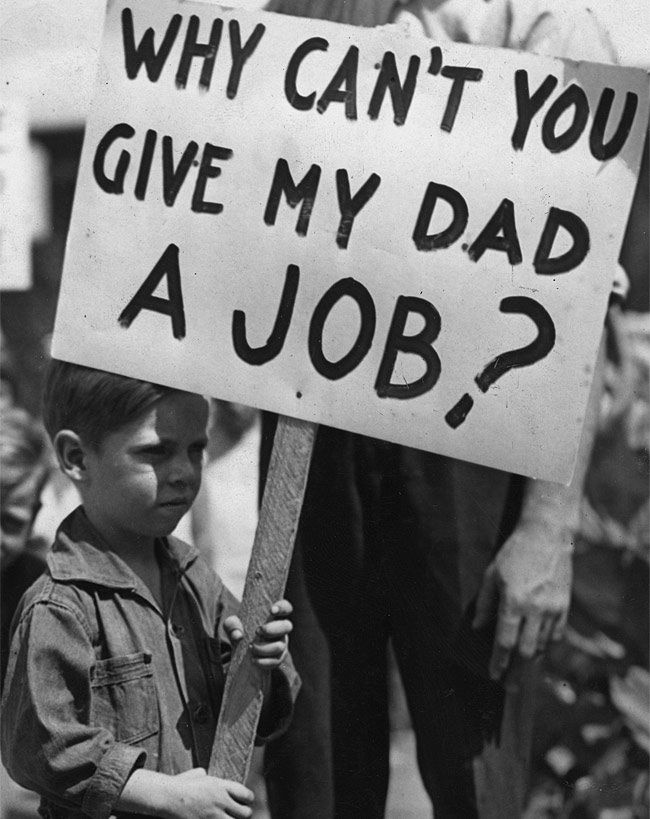

After this, the amount of debt incurred by spenders was astronomical. Bankruptcies, repossessions and foreclosures saw their rates hike at speeds like never before. People continued to struggle to pay off debt, find work and even survive. Folks were starving and poverty levels skyrocketed. People facing drought and famine in rural areas, mostly from the “dust bowl”, flooded into cities to find a decent living, only to add more strain to the existing situation.

The continuing collapse only drove the situation further down. Those who had money in the bank wanted to take it out. The banks couldn’t handle the massive payouts and failed to provide the liquid assets they required. One by one banks continued to close their doors.

It seemed that the wrath of God was on the world economy- it extended further than the United States. The entire industrialized world was affected. International trade was strained as one of the fastest growing economies stagnated and was seemingly brought to nought.

What Were the Solutions?

As the economic strain carried on, political leaders were forced to take action. Growth was sought from the bailing out of banks, as money was given to pay out business loans that were thought to bring more life to the economy by giving employers opportunities to expand. However, there was little to show.

The following presidential administration, that of Roosevelt, took a different course of action. The New Deal, the instating of the FDIC, SEC and Social Security amongst a variety of other social programs, as controversial they were, played a helping hand in the growth seen following 1933. However, the programs were not enough to account for the amount of growth needed to get out of the depression as soon as it happened- something else had to lend a hand.

WWII seemed to have come at the right time, at least in terms of job growth and the need for rising production and trade across the globe. Many countries, especially the United States, saw more growth in their GDPs after only a few years and much more since then. More work, workers, production and a rising GDP. Things were looking up, though just at the beginning of the deadliest war in human history.

However, just as the fall of the economy is not only attributed to the crash of 1929, the recovery cannot be fully attributed to the war or the economic policies alone. Just as the policies and mismanagement of money preceding the depression fueled the collapse, so the combination of policies and a dire need to fill the workforce fueled the rebound.

How Can We Apply This to Today?

Having learned from the past, it seems as though a depression is not exactly likely, though still possible (especially in light of the economic state of our current day). The policies set in place during the great depression, and those added/modified since then, have helped to keep us out of that depressive state, and kept the great recession from advancing to the level of depression. However, inflationary market manipulation and unprecedented growth in value of certain assets can be warning signs of recessive trends.

The world economy is in a fascinating spot. Commodities are seemingly skyrocketing in value, central banks keep printing their fiat, and more fears of regulation and shutdown continue to add pressure to the political-economic scene. There’s a lot of fear, a lot of uncertainty, and various other obstacles to overcome such as natural disaster and pestilence. However, through the great depression, we can see that problems see some level of solution. Human beings are resilient and can overcome anything that life throws our way. Though messy and not always the most well practiced in application of solutions, life finds a way. Resilience of humanity and frailty of economic activity are the two most important lessons to learn from the depression. May we beware, but hold hope for growth.